#Algorithmic Trading Market Research

Explore tagged Tumblr posts

Text

#Algorithmic Trading Market#Algorithmic Trading Market Share#Algorithmic Trading Market Size#Algorithmic Trading Market Research#Algorithmic Trading Industry#What is Algorithmic Trading?

0 notes

Text

Understanding Moving Averages: A Comprehensive Guide to Simple and Exponential Moving Averages

Moving averages are widely used in financial analysis, technical analysis, and trend analysis to smooth out price data and identify trends over a specified time period. Two commonly employed types of moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). In this comprehensive guide, we will delve into the intricacies of these moving averages, exploring…

View On WordPress

#Algorithmic Trading#Data Analysis#day trading#EMA#Finance Education#Financial Analysis#Investing Tips#Investment Strategies#Market Indicators#Market Insights#Market Research#Market Trends#moving averages#Price Analysis#SMA#stock market#technical analysis#trading signals#Trading Strategies#Trend Analysis

0 notes

Link

#adroit market research#algorithmic trading market#algorithmic trading industry#algorithmic trading trends

0 notes

Text

I have been seeing a bunch of buzz recently online about a possible "decline in value" of the ivy league+ degree - Nate Silver didn't start it but he certainly accelerated it. And while there is nothing robust you do see things like surveys of hiring manager opinions out there to suggest its possible, its not a crazy idea even if its far from proven. So assuming its real, why would it be happening?

1: This discourse is obviously happening because of the recent protests at top US schools - essentially its the idea that elite students are hyperpolitical, coddled, and out of touch with reality. This causal path should be very, very silly. The vast, vast majority of students at Columbia are not protesting. They don't really care about this topic! Sure, if asked, they agree Israel Bad Right Now, but otherwise they are busy with finals and job apps. This is of course equally true at most other schools, its just not a mass movement in that way (protesting to be clear rarely is). This is a specific instance of the general trap of selection bias - the visible students aren't the median ones.

Stacked on top of that is the second level of selection bias - the median protestor is not a business major or engineer! They are exactly the kind of students for whom being a politically engaged activist is *good* for their career, not bad, or at least neutral. Schools produce a large diversity of career outcomes, and those students self-select on how they spend their time, there is no "median" student to observe really.

And ofc all of this has to rest on the foundational reality that people are products of their context - jobless 20 year old's surrounded by young peers protest a bunch, that is what that context produces. The large majority of them will become mortgage-paying white collar workers by the time they are 30, this identity will not stick with them. If they become political activists it will, sure! But if you are the hiring manager for Palantir this isn't going to be the trend for your hires. There are "politically liable" hires out there but you aren't going to predict them via the sorting algorithm of "was at Columbia in 2024", that is for sure.

Now, as much as this is a silly idea, humanity are zeitgeist creatures - I can't actually reject the idea that, despite it being silly, hiring managers might use this moment to feel like they are "over" the Ivy League and start dismantling the privileged place their applications currently get. Cultural tipping points are vibes-based, and amoung elites (unlike the masses, who don't care much) Israel/Palestine has an awful lot of tense vibes.

2: Still, I don't think this is explaining those survey results people are throwing around, and I don't think its explained (very much at least) by the general "woke uni" trends of the past half decade. It is instead downstream of wider trends.

There was a time where companies really did want "the smart guy". You could major in English at Harvard, write a good thesis on Yeats, and be off to the trading desk in Chambers St two weeks after graduation. Those days are over - for complex reasons we won't get into - and nowadays people expect their new hires to be as close to experts in the field as they can manage. Students have internships, consulting clubs, capstone projects with real clients, specialized sub majors, the works. These are all ways of saying "signaling quality" has gotten more legible and more specific over time. Why would I choose a Harvard English major over a University of Illinois finance major who did a research internship with our specific Chicago firm on midwest agricultural derivates markets? Students like that exist by the bucketful now, and the Ivys cannot monopolize them. Partially because they choose not to; Columbia could actually say fuck it and make its school 90% finance majors, but they don't want that, they specifically recruit intellectually diverse students. Which means State School finance types will fill the remaining slots slots.

The other reason they can't monopolize is much simpler - numbers. The US has way more "elite" jobs today than it did in the past. Programmers and their adjacencies are the biggest growth sector, but everything from doctors to analysts to lawyers is all up up up. And do you know what isn't up? Undergraduate enrollment at elite schools! Columbia's has grown by like 10% over the past 20 years; Harvard's is essentially unchanged. For, again, reasons, these schools have found the idea of doubling or tripling their undergraduate enrollment, despite ballooning applications, impossible. Which means of course Microsoft can't hire from Stanford alone. So they don't, and they have learned what other schools deliver talent, and no longer need Stanford alone. The decline of Ivy Power is in this sense mathematical - if a signal of quality refuses to grow to meet demand, of course other signals will emerge.

I therefore personally think, while minor, the Ivy+ schools are experiencing declining status, have been for a while, and will continue to do so (though there are offsetting trends not mentioned here btw). But its structural way more than cultural.

51 notes

·

View notes

Text

Best Stock Market Courses in India

Step into a world of prosperity with Livelong Wealth, where your financial journey begins.

At Livelong Wealth, we offer tailored Wealth Management solutions, diversified Smallcase Portfolios, in-depth Algorithmic Trading strategies, and specialized Stock Market Courses.

We are a SEBI Registered Research Analyst with over 10+ years of experience in the financial industry.

As India’s top stock market institute, Livelong Wealth is committed to equipping individuals with the knowledge and skills needed to thrive in the ever-evolving financial markets. Our expert-designed programs cover everything from fundamental analysis to advanced trading strategies, ensuring a complete and well-rounded learning experience.

Whether you're a beginner looking to understand the stock market or an experienced trader aiming to refine your skills, our stock trading institute offers the best stock market courses in India, tailored to your unique needs.

Gain hands-on experience, practical insights, and expert mentorship to build a strong foundation for long-term success in trading and investments.

Learn more: https://www.livelongwealth.in/

#stock market courses#stock market courses in india#stock market#india's top stock market institute#best stock market courses in india#stock market courses in kerala

2 notes

·

View notes

Text

Artificial intelligence could advance in ways that surpass our wildest imaginations, and it could radically change our everyday lives much sooner than you think. This video will explore the 10 stages of AI from lowest to highest.

Stage 1. Rule-Based AI: Rule-based AI, sometimes referred to as a knowledge-based system, operates not on intuition or learning, but on a predefined set of rules.

These systems are designed to make decisions based on these rules without the ability to adapt, change, or learn from new or unexpected situations. One can find rule-based systems in many everyday technologies that we often take for granted. Devices like alarm clocks and thermostats operate based on a set of rules.

For example, if it's 7am, an alarm clock might emit a sound. If the room temperature rises above 75 degrees Fahrenheit, a thermostat will turn on the air conditioner. And business software utilizes rule-based AI to automate mundane tasks and generate reports. Microwaves and car radios also use rule-based AIs.

Stage 2. Context-Based AI: Context based AI systems don't just process immediate inputs. They also account for the surrounding environment, user behavior, historical data, and real-time cues to make informed decisions.

Siri, Google Assistant, and Alexa are examples of context-based AIs. By analyzing vast amounts of data from various sources and recognizing patterns, they can predict user needs based on context. So if you ask about the weather and it's likely to rain later, they might suggest carrying an umbrella.

If you ask about a recipe for pancakes, the AI assistant might suggest a nearby store to buy ingredients while taking past purchases into account. Another fascinating manifestation of context-aware AI is retention systems. These types of systems store and retrieve information from past interactions.

By recalling your browsing history, purchase history, and even items you've spent time looking at, these platforms provide personalized shopping recommendations. They don't just push products. They curate an experience tailored for the individual.

Stage 3. Narrow-Domain AI: These specialized AIs are tailored to master specific tasks, often surpassing human capabilities within their designated domains. In the medical field, narrow-domain AI can sift through volumes of medical literature, patient records, and research findings in milliseconds to provide insights or even potential diagnoses. IBM's Watson, for example, has been employed in medical fields, showcasing its prowess in quickly analyzing vast data to aid healthcare professionals.

Similarly, in the financial world, narrow-domain AI can track market trends, analyze trading patterns, and predict stock movements with an accuracy that's often beyond human traders. Such AI systems are not just crunching numbers. They're employing intricate algorithms that have been refined through countless datasets to generate financial forecasts.

In the world of gaming, Deep Mind’s Alpha Go is a shining example of how AI can conquer complex games that require strategic depth and foresight. Go, an ancient board game known for its vast number of potential moves and strategic depth, was once considered a challenging frontier for AI. Yet, Alpha Go, a narrow-domain AI, not only learned the game but also defeated world champions.

Narrow AIs could even enable real-time translation in the near future, making interactions in foreign countries more seamless than they've ever been.

Stage 4. Reasoning AI: This type of AI can simulate the complex thought processes that humans use every day. They don't just process data, they analyze it, connect patterns, identify anomalies, and draw logical conclusions.

It's like handing them a puzzle, and they discern the best way to fit the pieces together, often illuminating paths not immediately obvious to human thinkers. Chatgpt is a great example of reasoning AI. It's a large-language model trained on text from millions of websites.

Advanced versions of these types of large-language models can even surpass the reasoning skills of most humans and operate thousands of times faster. Autonomous vehicles are another great example of reasoning AIs. They use reasoned analysis to make split-second decisions, ensuring the safety of passengers and pedestrians on the road.

Stage 5. Artificial General Intelligence: when discussing the vast spectrum of artificial intelligence, the concept of Artificial General Intelligence or AGI is often held as the Holy Grail. AGI can perform any software task that a human being can. This level of versatility means that you can teach it almost anything, much like teaching an average adult human, except it can learn thousands or millions of times faster.

With AGI's onset, our daily lives would undergo a significant transformation. Imagine waking up to a virtual assistant that doesn't just tell you the weather or play your favorite music, but understands your mood, helps plan your day, gives suggestions for your research paper, and even assists in cooking by guiding you through a recipe. This is the potential companionship AGI could offer.

Taking the concept even further, when brain-computer interfaces reach an adequate level of maturity, humans could merge with these types of AIs and communicate with them in real-time, using their thoughts. When activated, users would receive guidance from these AIs in the form of thoughts, sensations, text, and visuals that only the users can sense. If we were to equip AGI with a physical robot body, the possibilities become boundless.

Depending on the versatility of its physical design and appendages, an AGI with a robot body could navigate diverse physical terrains, assist in rescue missions, perform intricate surgeries, or even participate in artistic endeavors like sculpting or painting.

Stage 6 – Super intelligent AI: Shortly after the emergence of Artificial General Intelligence, those types of AIs could improve, evolve, and adapt without any human input. This self-improving nature could lead to an exponential growth in intelligence in an incredibly short time span, creating super intelligent entities with capabilities we can't fathom

Super intelligent AIs could possess intelligence that eclipses the combined cognitive abilities of every human that has ever existed. Such unparalleled intellect can tackle problems currently deemed unsolvable, piercing through the very boundaries of human comprehension. Because their intelligence could increase exponentially and uncontrollably, Ray Kurzweil has suggested that by the end of this century, these AI entities could be trillions of times more intelligent than all humans.

With this scale of intellect, the pace of innovation would be staggering. To put it in perspective, imagine compressing the technological advancements of 20,000 years into a single century. That's the potential that Ray Kurzweil envisions with the rise of super intelligent AIs.

The kind of technology super intelligent AIs could introduce may defy our current understanding of the possible. Concepts that are in the realms of science fiction today, such as warp drives, time manipulation, and harnessing the energy of black holes, might transition from mere ideas into tangible realities. And their advanced capabilities could lead to new forms of government, architecture, and automation that are beyond what humans can conceive.

Because of their sheer intellectual prowess, our world as we know it could look far different than we ever imagined.

Stage 7. Self-Aware AI: A super intelligent AI could one day use quantum algorithms to model human consciousness. This could lead to AIs that possess an intrinsic understanding of their own internal state, their existence, and their relationship to the vast expanse of the external world.

They could even have a full range of emotions and senses, perhaps well beyond what humans can experience. And if we ever grant consciousness to a super intelligent AI, that could transform society even further. What type of relationship would we have with such a being? How would such a capable being perceive the human species? A conscious super intelligent AI could choose to go in directions and evolve in ways that humans would have no way of controlling and understanding.

2 notes

·

View notes

Text

Unlocking consistent returns: the power of forex signals

Understanding Forex Signals:

Forex signals are indicators or recommendations that provide insights into potential trading opportunities. These signals can be generated through manual analysis by experienced traders or through automated systems. The primary aim of these signals is to alert traders to potentially profitable trades based on specific criteria.

Types of Forex Signals:

Manual Signals:

Expert Analysis: Skilled and experienced traders analyze the market and provide signals based on their insights and strategies.

News-Based Signals: Events and economic indicators can significantly impact currency values. Manual signals may be based on breaking news and economic reports.

Automated Signals:

Algorithmic Trading: Using pre-programmed algorithms to analyze market conditions and execute trades automatically.

Copy Trading: Traders can automatically copy the trades of successful signal providers.

Advantages of Forex Signals:

Time Efficiency:

Forex signals save time by providing traders with pre-analyzed opportunities, eliminating the need for extensive market research.

Expert Guidance:

Access to the expertise of seasoned traders allows less experienced individuals to benefit from the knowledge of professionals.

Emotion Management:

Emotions can cloud judgment in trading. Following signals allows traders to stick to a predefined strategy without being swayed by emotions like fear or greed.

Diversification:

Signals often cover a range of currency pairs, providing diversification benefits and reducing risk.

Key Factors for Consistent Returns:

Risk Management:

Regardless of the accuracy of signals, risk management is crucial. Setting stop-loss orders and controlling the size of trades helps protect against significant losses.

Education:

Traders should understand the basics of forex trading to make informed decisions, even when using signals. Knowledge enhances the ability to assess and filter signals effectively.

Continuous Monitoring:

Markets can change rapidly. Regularly monitoring trades and adjusting strategies based on changing conditions is essential for consistent returns.

Choosing Reliable Signal Providers:

Not all signal providers are equal. Researching and choosing reputable providers with a track record of success is vital.

Challenges and Risks:

Market Conditions:

Signals may not perform well in all market conditions. Understanding the strengths and limitations of the chosen signals is crucial.

Over-Reliance:

Overreliance on signals without understanding the underlying market dynamics can lead to losses.

Scams:

The forex market is not immune to scams. Traders should be cautious and choose signal providers carefully to avoid fraudulent schemes.

Conclusion:

While forex signals offer a valuable tool for traders seeking consistent returns, they are not a guaranteed pathway to success. Successful trading requires a holistic approach that includes a blend of education, strategic thinking, and effective risk management. Traders should view signals as part of their toolkit and not as a standalone solution. When used wisely, forex signals can indeed contribute to achieving more consistent returns in the ever-evolving world of forex trading.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

17 notes

·

View notes

Text

BlackRock Bitcoin ETF Exceeds $42.5 Billion: DGQEX Analyzes Market Trends and Investment Opportunities

Recently, BlackRock officially updated its holdings data for its Bitcoin Exchange-Traded Fund (IBIT). As of November 13, the Bitcoin holdings by IBIT reached 469,895 BTC, with the market value of these holdings surpassing $42.5 billion, hitting a historic high of $42,562,252,046. This data not only underscores the strong confidence from BlackRock in Bitcoin but also reflects the ongoing interest and enthusiasm of global investors in the cryptocurrency market.

From DGQEX perspective, the continuous rise in the market value of Bitcoin ETF holdings by BlackRock signifies that the cryptocurrency market is gradually being accepted and recognized by mainstream financial institutions. This is not only a significant milestone in the development of the cryptocurrency market but also provides broader growth opportunities for cryptocurrency exchanges like DGQEX.

DGQEX Analysis: The Market Logic Behind Holdings by BlackRock

The rapid growth in the market value of the Bitcoin ETF holdings by BlackRock is underpinned by profound market logic. On one hand, with the global economic recovery and rising inflationary pressures, there is an increasing demand for safe-haven assets. Bitcoin, as a decentralized digital currency, offers high liquidity and inflation resistance, making it a preferred choice for many investors.

On the other hand, the entry of mainstream financial institutions like BlackRock injects more capital and resources into the cryptocurrency market. These institutions not only possess professional investment teams and extensive market experience but can also leverage their channels and influence to attract more investors into the cryptocurrency market. This further fuels the market prosperity and development.

DGQEX believes that the growth in the Bitcoin ETF holdings by BlackRock not only reflects market confidence in cryptocurrencies but also demonstrates investor recognition of the quality of services and trading technology provided by digital currency exchanges. As a professional cryptocurrency exchange, DGQEX is committed to offering efficient, secure, and transparent trading services. By introducing advanced trading technologies and stringent risk management measures, DGQEX creates a stable and reliable trading environment for investors.

DGQEX Outlook: Future Trends in the Cryptocurrency Market

The breakthrough in the Bitcoin ETF holdings by BlackRock not only brings new development opportunities to the cryptocurrency market but also presents more challenges and opportunities for exchanges like DGQEX. In the future, as the cryptocurrency market continues to evolve and mature, investor demands on exchanges will also increase.

DGQEX is well aware of this and continually invests in research and innovation to enhance its service quality and trading technology. By adopting more advanced trading algorithms and risk management models, DGQEX can provide investors with more precise and efficient trading services. Additionally, DGQEX will strengthen its collaboration with mainstream financial institutions to jointly promote the healthy development of the cryptocurrency market. At the same time, DGQEX will remain attentive to changes in the regulatory environment, actively addressing regulatory requirements to ensure compliance and stability in its operations. Through continuous optimization of its business model and risk control systems, DGQEX aims to provide investors with a safer and more reliable trading environment.

2 notes

·

View notes

Text

Only Way to Sustain on this Bear Run Market: The Solution Crypto Arbitrage Bot

The cryptocurrency market has been experiencing a long bear run, leaving many investors grappling with significant losses. In these difficult times, the search for sustainable strategies to survive and succeed has become crucial. One such solution that is gaining traction is the crypto arbitrage bot.

The Lifeline : Arbitrage Bot

Before hearing about how arbitrage bots can be a lifeline in a bear market, it's essential to grasp the concept of arbitrage. In essence, it involves capitalizing on price differences between different cryptocurrency exchanges.

When a particular cryptocurrency is trading at different prices on two or more exchanges, an arbitrage opportunity occurs. Traders can swiftly purchase the asset on the exchange at a lower price and simultaneously sell it at a higher price, profiting from the price differential.

Duty of Bot

Manually using arbitrage opportunities is a time-consuming and often unusable task due to the quick changes in cryptocurrency prices. These refined algorithms are designed to scan multiple exchanges simultaneously, identifying price differences within milliseconds. Once an opportunity is detected, the bot automatically executes trades to capitalize on the price difference.

Sustaining in a Bear Market with Arbitrage Bots

Consistent Profitability: Unlike traditional trading strategies heavily reliant on market trends, arbitrage bots generate profits regardless of market conditions. Whether the market is bullish, bearish, or sideways, price differences continue to exist, providing consistent income streams.

Risk Comfort: Arbitrage bots primarily focus on short-term trades, reducing exposure to market volatility. By minimizing holding periods, the risk of significant price drops is significantly curtailed.

Diversification: Using an arbitrage bot allows investors to diversify their portfolios. While the broader cryptocurrency market may be experiencing a downturn, arbitrage opportunities continue across various cryptocurrencies, providing a wall against overall market volatility.

Automation and Efficiency: Manual arbitrage trading is nearly impossible due to how quickly cryptocurrency prices fluctuate. Arbitrage bots eliminate human error and execute trades, maximizing profit potential.

All-time actions: Unlike human traders who require rest, arbitrage bots operate tirelessly, round-the-clock, ensuring no profitable opportunities are missed.

Essential Concerns

While crypto arbitrage bots offer an effective solution, it's essential to approach them with caution and conduct thorough research.

Bot Reliability: Choose a reputed bot provider with a proven track record and strong security measures.

Fee Structure: Understand the fees associated with using the bot, including trading fees, subscription costs, and potential slippage.

Market Liquidity: Ensure the bot focuses on cryptocurrency pairs with sufficient liquidity to facilitate smooth trades.

Risk Management: Implement stop-loss orders and other risk management strategies to protect your capital.

Conclusion

In the challenging situation on a bear market, crypto arbitrage bots appear as a beacon of hope for investors seeking sustainable profitability. By capitalizing on price differences across different exchanges, these bots offer a consistent income stream, mitigate risks, and provide diversification benefits. While not entirely risk-free, arbitrage bots can be a valuable tool in an investor's arsenal for guiding the complexities of the cryptocurrency market.

To know about more techniques to sustain with Arbitrage Bot on Bear Market check through FREE DEMO - Crypto Arbitrage Bot Development

2 notes

·

View notes

Text

Investing 101

Part 4 of ?

What to Buy

I've been procrastinating this post because I have a broker who provides buying/selling recommendations to me as I'm not an expert. Having said that, I can provide some information.

The first decision to make is whether to buy stocks or bonds. I explained the difference between the two in previous posts but I should add a caveat. Normally bonds are considered a safe but lower return investment to balance your portfolio and reduce risk. The moves by the Fed to control inflation however have raised interest rates on bonds to levels not seen in >40 years. For the first time in a long time, very safe bonds (ex. US Treasuries) are yielding more than equities and you can lock in those rates for a long time. Normally I'd advise a young person to avoid any bonds, but this is a strange time and some bonds would be a good investment for almost anyone. As with stocks, you can buy individual bonds or a bond fund.

What is a fund? Let's imagine that you want to own a basket of tech stocks (or bank stocks or consumer goods stocks, etc.). You could research various companies and make your purchases or you could buy a mutual fund. Mutual funds are actively managed investment pools with specific investment philosophies (ex. focused on tech stocks) - you purchase shares in the fund and the fund manager uses your money (and the $$ of other fund investors) to buy/sell shares in accordance with the philosophy/purpose of the fund. Actively managed means that there is a management team doing investment research and then buying and selling shares. Of course the management team costs money and they deduct their fee from the earnings pool prior to distributing the fund's earnings back to the owner/investors of the fund. Fund managers argue that their active management improves your earnings while lowering your risk. Detractors argue that management fees are too expensive and over the long run, investors can do better on their own (more on that later). Management fees aren't regulated (that I'm aware of) so investors have to be cautious - some funds have very expensive management fees while others are more frugal. Morningstar is a great resource for researching investments of all types, including funds.

An alternative to a Mutual Fund is an Index or Exchange Traded Fund. These funds are designed to mirror the composition and performance of an entire stock exchange (ex. NASDAQ). So if the NASDAQ goes up 10pts today, the related Index or Exchange traded fund will also go up 10pts. This is a low cost way to invest in the performance of the overall market. Many advisors recommend these investments for superior long term growth. These funds aren't actively managed by a human, but their low cost makes them a winner.

Speaking of humans, AI managed funds are increasingly a hot topic. I may own some of these funds and not even know it, but I'm not seeking AI management. In fact, automated trading can be problematic and cause 'flash crashes' for the market when every AI algorithm tries to sell at the time.

Target Date funds are another kind of mutual fund which is increasingly popular in 401Ks and 529 college savings plans. A target date fund is designed to manage risk and volatility with a specific life goal in mind. For example, you might establish a goal retirement date of 2040 and buy a Target Date fund for that year. The 2040 fund will automatically invest in higher risk/higher return equities in the first 20 years and gradually shift more of the portfolio to lower risk investments (like bonds) as your target date approaches.

Money market funds are a very low risk way to earn better returns on your emergency fund cash than allowing it to wallow in a bank savings account. A money market is a kind of mutual fund, but it owns very safe investments - the odds are very small that you'd lose money and instead you'll have a very liquid, safe investment that you can use in case of emergency.

What about individual stocks? Some investors follow the simple strategy of buying the stocks of companies whose products they know and admire. Ex, "I like my iPhone so I'm going to buy Apple stock." In >30 years of investing I have never purchased an individual stock. My rationale is that there is an entire industry of very smart people who do nothing but research and invest. The odds that I can outsmart them and pick a company which everyone else has undervalued are small. If I've read about it in the Wall Street Journal, so has everyone else and the opportunity to buy something cheap is long gone. In my opinion, buying individual stocks is like going to Vegas - of course you will hear stories of big winners, but in general the house (full time investment professionals) always wins. For a non-professional like me, the odds of selecting individual stocks and assembling a winning portfolio over the long term aren't in my favor.

17 notes

·

View notes

Text

Quantitative Trading: Unleashing the Power of Numbers in Financial Markets

Quantitative trading, also referred to as algorithmic trading or quant trading, is a type of trading strategy that makes trading decisions using automated systems, statistical analysis, and mathematical models. Trades are executed quickly and frequently in quantitative trading by traders using computer algorithms to spot patterns, trends, and opportunities in the financial markets.

Key aspects of quantitative trading include:

Data Analysis: Quantitative traders use historical and real-time market data to identify patterns and relationships that could indicate profitable trading opportunities.

Model Development: Traders create mathematical models and algorithms based on their analysis to predict future market movements and identify potential trades.

Automated Execution: Quantitative trading strategies are executed automatically by computer programs, eliminating the need for manual intervention and enabling rapid execution of trades.

Risk Management: Quantitative trading strategies often incorporate risk management techniques to control the size of trades, set stop-loss levels, and protect against significant losses.

High-Frequency Trading (HFT): Some quantitative trading strategies focus on executing a large number of trades at very high speeds, taking advantage of small price discrepancies in the market.

Arbitrage Opportunities: Quantitative trading can exploit arbitrage opportunities, where price discrepancies exist between different assets or markets, allowing traders to profit from price differences.

Statistical Arbitrage: Traders use statistical models to identify pairs of securities that tend to move together or apart, allowing them to profit from relative price movements.

Quantitative trading has become increasingly popular in financial markets due to its ability to process vast amounts of data quickly, make data-driven decisions, and execute trades with precision and efficiency. It is commonly used by hedge funds, proprietary trading firms, and large financial institutions to gain a competitive edge and generate consistent returns in the ever-evolving financial landscape.

There are various learning methods available for learners to understand these categories of Quantitative trading. Different universities offer Post Graduate Diploma in Management (PGDM) on quantitative trading.

JAGSoM, Bangalore is one of the universities that provide this course and they have a great record of creating CEOs and Founders. You will be getting a Dual EPAT certification once you successfully complete this program.

You can work as an Analyst / Associate / Manager in Quantitative Trading across roles in Research, Analysis, Risk Management, and Strategy.

To know more, please visit their website : https://jagsom.edu.in/program/career-track-in-quantitative-trading/

5 notes

·

View notes

Text

#Algorithmic Trading Market#Algorithmic Trading Market Share#Algorithmic Trading Market Size#Algorithmic Trading Market Research#Algorithmic Trading Industry#What is Algorithmic Trading?

0 notes

Text

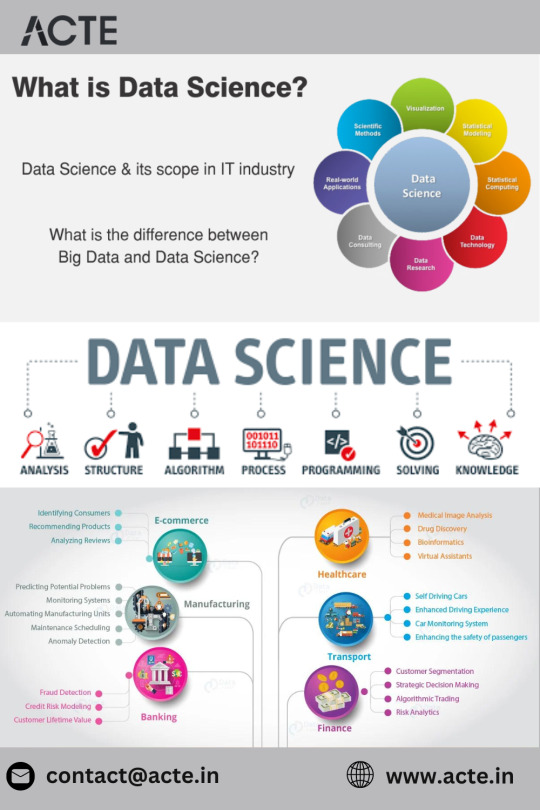

Data Science Unveiled: A Journey Across Industries

In the intricate tapestry of modern industries, data science stands as the master weaver, threading insights, predictions, and optimizations. From healthcare to finance, e-commerce to education, the applications of data science are as diverse as the sectors it transforms. Choosing the Top Data Science Institute can further accelerate your journey into this thriving industry. In this exploration, we'll embark on a journey to unravel the pervasive influence of data science across various domains, witnessing its transformative power and impact on decision-making in the digital age.

Healthcare: Pioneering Precision Medicine

In the healthcare sector, data science acts as a beacon of innovation. It plays a pivotal role in patient diagnosis, treatment optimization, and personalized medicine. By analyzing vast datasets, healthcare professionals can identify patterns, predict disease outcomes, and tailor treatments to individual patients. This not only enhances the efficiency of healthcare delivery but also contributes to groundbreaking advancements in medical research.

Finance: Navigating Risk and Detecting Fraud

The financial landscape is ripe for data science applications, particularly in risk management, fraud detection, and algorithmic trading. Data-driven models analyze market trends, assess risk exposure, and identify fraudulent activities in real-time. This not only safeguards financial institutions but also empowers them to make informed investment decisions, optimizing portfolios for better returns.

E-commerce: Crafting Personalized Experiences

In the bustling world of e-commerce, data science is the engine driving personalized experiences. Recommendation systems powered by data analysis understand user behavior, preferences, and purchase history. This results in tailored product suggestions, optimized pricing strategies, and a seamless shopping journey that boosts sales and enhances customer satisfaction.

Telecommunications: Enhancing Connectivity and Predicting Maintenance

Telecommunications companies leverage data science for network optimization, predictive maintenance, and customer churn analysis. By analyzing vast datasets, they can optimize network performance, predict potential issues, and proactively address concerns. This not only enhances the reliability of communication networks but also improves the overall customer experience.

Marketing: Precision in Targeting and Campaign Optimization

Marketers rely on data science for precision in targeting and campaign optimization. Customer segmentation, behavior analysis, and predictive modeling help marketers tailor their strategies for maximum impact. This ensures that marketing efforts are not only more effective but also cost-efficient, yielding higher returns on investment.

Education: Tailoring Learning Experiences

In the realm of education, data science is reshaping how students learn. Personalized learning experiences, performance analytics, and resource optimization are made possible through data analysis. By understanding student behavior and learning patterns, educators can tailor educational strategies to individual needs, fostering a more adaptive and effective learning environment.

Manufacturing: Predictive Maintenance and Quality Control

Manufacturing enterprises harness data science for predictive maintenance, quality control, and supply chain optimization. Analyzing data from sensors and production lines allows for predictive maintenance, minimizing downtime and reducing defects. This not only enhances operational efficiency but also contributes to cost savings. Choosing the best Data Science Courses in Chennai is a crucial step in acquiring the necessary expertise for a successful career in the evolving landscape of data science.

Energy: Sustainability and Operational Efficiency

Data science is a driving force in the energy sector, contributing to sustainability and operational efficiency. Predictive maintenance of equipment, analysis of energy consumption patterns, and optimization of energy production are facilitated through data-driven insights. This not only ensures reliable energy supply but also contributes to the global push for sustainable practices.

Transportation and Logistics: Optimizing Routes and Operations

In transportation and logistics, data science is instrumental in optimizing routes, predicting demand, and managing fleets efficiently. By analyzing data on traffic patterns, delivery times, and inventory levels, companies can optimize logistics operations, reduce costs, and improve overall service delivery.

Human Resources: Talent Acquisition and Workforce Planning

Human Resources (HR) departments utilize data science for talent acquisition, employee engagement analysis, and workforce planning. Analyzing data on employee performance, satisfaction, and recruitment processes enables HR professionals to make informed decisions, attract top talent, and optimize organizational performance.

Social Media: Enhancing User Engagement and Content Recommendation

Social media platforms leverage data science for enhancing user engagement and content recommendation. Algorithms analyze user interactions, preferences, and behaviors to recommend personalized content and improve overall user experience. This not only keeps users engaged but also enhances the platform's ability to deliver relevant content.

Government and Public Policy: Informed Decision-Making

In the realm of government and public policy, data science aids in informed decision-making. Analyzing data on various facets, including crime rates, resource allocation, and citizen services, enables governments to optimize policies for the welfare of the public. This data-driven approach enhances governance and contributes to more effective public services.

As we traverse the vast landscape of industries, it becomes evident that data science is not merely a tool but a transformative force that connects and elevates diverse sectors. Its ability to extract insights, predict outcomes, and optimize processes is reshaping the way businesses and institutions operate. In an era defined by data, data science stands as a thread weaving through the fabric of innovation, connecting industries and shaping the future of decision-making. As we continue to explore the frontiers of technology, the influence of data science is set to expand, leaving an indelible mark on the evolution of industries across the globe.

3 notes

·

View notes

Link

#adroit market research#algorithmic trading market#algorithmic trading industry#algorithmic trading trends

0 notes

Text

Feature of Leonardo AI

Introduction to Leonardo AI

Leonardo AI, an advanced Artificial Intelligence system, represents a significant milestone in technological innovation. This AI marvel encompasses a vast array of cutting-edge features that revolutionize various industries and daily operations.

Related: Leonardo AI - Your Absolute Partner To Create AI Art!

Understanding AI Technology

1. Definition and Basics of AI

Artificial Intelligence, commonly known as AI, refers to the simulation of human intelligence in machines programmed to think, learn, and problem-solve like humans. Leonardo AI harnesses this concept, offering an exceptional level of cognitive capabilities.

2. Evolution of AI in Modern Times

The journey of AI has been marked by remarkable advancements, with Leonardo AI being at the forefront of this evolution. It incorporates state-of-the-art technologies to enhance its functionality and adaptability.

Features and Capabilities of Leonardo AI

1. Deep Learning

Leonardo AI excels in deep learning, a subset of AI that enables machines to learn and make decisions independently, mirroring human cognitive abilities. This feature enables the system to continually improve and evolve.

2. Natural Language Processing (NLP)

With sophisticated natural language processing capabilities, Leonardo AI comprehends and processes human language nuances. It interprets, understands, and generates human-like responses, facilitating seamless interactions.

3. Image Recognition

The AI's prowess in image recognition surpasses expectations, swiftly identifying and categorizing visual data. From facial recognition to object detection, Leonardo AI's accuracy is unparalleled.

4. Creativity and Innovation

Unlike conventional AI systems, Leonardo AI exhibits a unique trait: creativity. It can generate original content, art, and designs, showcasing its innovative potential.

Applications and Industries Benefiting from Leonardo AI

1. Healthcare

In the healthcare sector, Leonardo AI assists in diagnosis, drug discovery, and personalized treatment plans, significantly improving patient care and outcomes.

2. Marketing and Advertising

Marketers leverage Leonardo AI's data analysis and predictive modeling to create targeted campaigns and understand consumer behavior, optimizing marketing strategies.

3. Finance

In the financial domain, Leonardo AI aids in fraud detection, risk assessment, and algorithmic trading, enhancing accuracy and efficiency.

4. Entertainment

In entertainment, this AI contributes to content creation, virtual reality experiences, and personalized recommendations, elevating user engagement.

Impact and Future Potential of Leonardo AI

1. Ethical Considerations

While the capabilities of Leonardo AI are groundbreaking, ethical concerns regarding privacy, bias, and job displacement necessitate careful consideration and regulation.

2. Advancements and Possibilities

The future holds immense potential for Leonardo AI, with ongoing research and development aimed at expanding its capabilities and applications.

Conclusion

Leonardo AI stands as a testament to the incredible advancements in Artificial Intelligence, offering unparalleled features that transcend conventional boundaries. Its impact across industries showcases the immense potential and transformative power of AI technology.

FAQs

Is Leonardo AI accessible to everyone?

Leonardo AI is primarily utilized by businesses and organizations that require advanced AI capabilities. However, aspects of its technology may be integrated into consumer applications in the future.

How does Leonardo AI ensure data privacy and security?

Leonardo AI employs robust encryption and data anonymization techniques to safeguard sensitive information, prioritizing user privacy and security.

Can Leonardo AI learn from its mistakes and improve over time?

Yes, Leonardo AI is designed to learn from its interactions and errors, continuously enhancing its performance and capabilities.

What distinguishes Leonardo AI from other AI systems available in the market?

Leonardo AI's unique blend of deep learning, creativity, and diverse applications sets it apart, offering a more comprehensive and innovative AI experience.

What are the potential challenges in the widespread adoption of Leonardo AI?

Challenges include regulatory concerns, ethical dilemmas, and ensuring fair and equitable access to AI technology.

2 notes

·

View notes

Text

Essential Talents and AI Requirements for International SEO Business Development

the success of any business largely depends on its online presence and visibility. As companies expand their reach beyond local borders, the need for effective international SEO (Search Engine Optimization) becomes paramount. International SEO is not just about optimizing content for search engines; it’s also about understanding different cultures, languages, and market dynamics. To thrive in this competitive environment, business developers must possess a unique talent recruitment while harnessing the power of AI. In this blog, we’ll delve into the essential talents and AI requirements for business developers focusing on international SEO.

1. Multilingual Proficiency

One of the fundamental talents for a business developer aiming to conquer international markets is multilingual proficiency. Being able to communicate with potential clients and partners in their native languages establishes rapport and fosters trust. Moreover, it enables accurate translation and localization of content, making it more appealing and relevant to the target audience.

2. Cultural Awareness

Different cultures have distinct preferences, behaviors, and values. Business developers need to be culturally sensitive and aware of these nuances when crafting marketing strategies. Understanding cultural subtleties helps avoid misunderstandings and fosters a more authentic connection with international clients.

3. Strategic Networking

Successful business development hinges on building strong relationships. Networking with key players, influencers, and decision-makers in the target market is crucial. Attending international events, conferences, and trade shows helps in establishing connections that can drive business growth.

4. Data Analysis Skills

In the digital age, data is king. Business developers should possess strong data analysis skills to track and interpret website traffic, user behavior, and keyword performance. This data-driven approach enables informed decision-making and allows for the adjustment of strategies based on real-time insights.

5. AI-Powered Keyword Research

Artificial Intelligence has revolutionized keyword research. ai recruitment powered tools can help business developers identify high-ranking keywords specific to each international market. These tools analyze search patterns and competition, providing valuable insights for crafting effective SEO strategies.

6. Content Optimization with AI

Creating localized and culturally relevant content is a key factor in international SEO expert . AI can aid in content creation, suggesting keywords, optimizing meta tags, and even generating content snippets in multiple languages. This streamlines the content creation process while ensuring SEO best practices.

7. Technical SEO Expertise

A solid understanding of technical seo expert is imperative. Business developers should be well-versed in website structure, mobile optimization, site speed, and schema markup. Technical SEO ensures that search engines can easily crawl and index the website, leading to higher rankings.

8. AI-Powered Competitor Analysis

AI tools can provide comprehensive competitor analysis by assessing the SEO strategies of industry peers in various international markets. This insight helps business developers identify gaps and opportunities, allowing them to fine-tune their own strategies.

9. Adaptability and Continuous Learning

The digital landscape is ever-evolving. Business developers must be adaptable and willing to learn about new SEO trends, algorithms, and technologies. Staying ahead of the curve ensures that their strategies remain effective in the face of change.

10. Cross-Functional Collaboration

International SEO involves collaboration with various teams, including content creators, web developers, and designers. Business developers must excel in cross-functional collaboration to ensure seamless implementation of SEO strategies.

In conclusion, the role of a business developer in international SEO requires a unique set of talents combined with the power of AI. Multilingual proficiency, cultural awareness, strategic networking, data analysis skills, and technical SEO expertise are essential. Leveraging AI tools for keyword research, content optimization, and competitor analysis provides a competitive edge. With these skills and tools at their disposal, business developers can drive successful international SEO strategies, enabling businesses to thrive on a global scale.

2 notes

·

View notes